The report highlights the advantages of a dedicated allocation to emerging market debt (EMD), emphasizing its strong historical returns and diversification benefits.

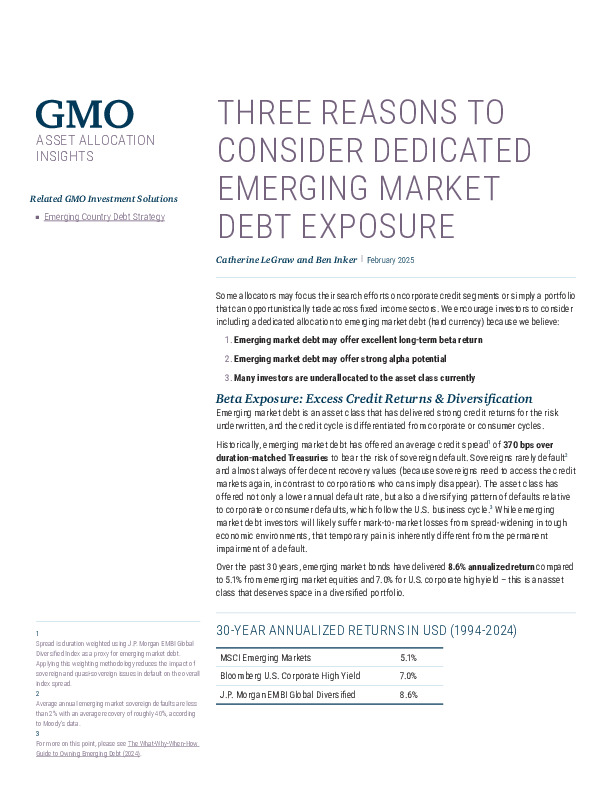

- Attractive Returns: Over 30 years, EMD delivered 8.6% annualized returns, outperforming emerging market equities and U.S. corporate high yield.

- Alpha Potential: Active management in EMD has consistently outperformed benchmarks due to market inefficiencies.

- Underallocation Risk: Many investors have limited exposure, missing out on diversification benefits.

Explore how EMD can enhance portfolio performance—read the full report for deeper insights.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.