Van Lanschot Kempen’s Dividend Team analyzes persistent valuation gaps between U.S. equities and global markets, revealing structural drivers and hidden opportunities.

Key Insights:

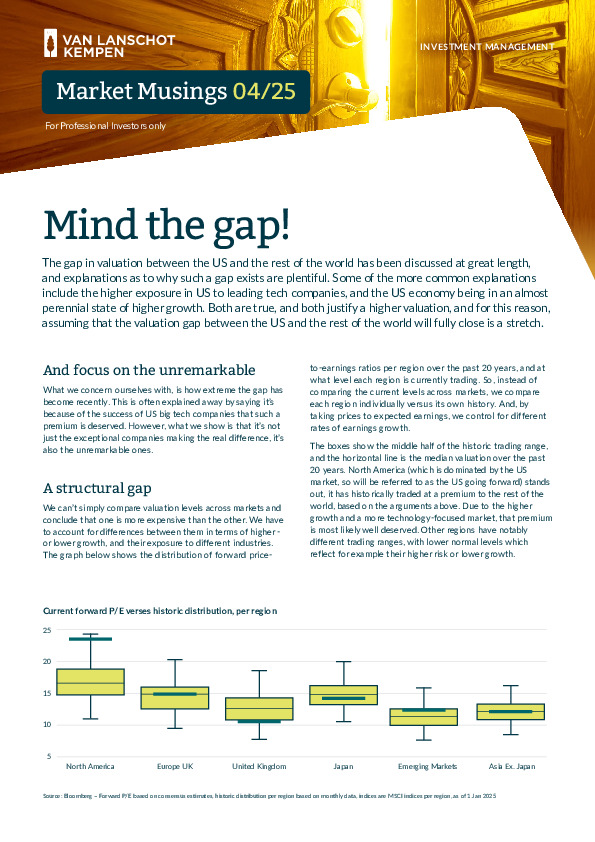

- Structural U.S. Premium: U.S. equities trade well above historic valuation ranges, not solely due to tech dominance but also expensive non-tech sectors.

- Europe More Attractive: European equities trade closer to or below historic medians, offering potential for positive surprises.

- Sector Discrepancies: Comparable sectors (e.g., consumer staples, financials) show large valuation differences without clear justification.

Explore the full analysis to uncover where global valuation gaps offer the best long-term opportunities.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.