The January 2025 Asset Allocation Outlook, authored by Van Lanschot Kempen’s investment team, analyzes global market performance and provides key investment strategies for the year ahead.

Key Highlights:

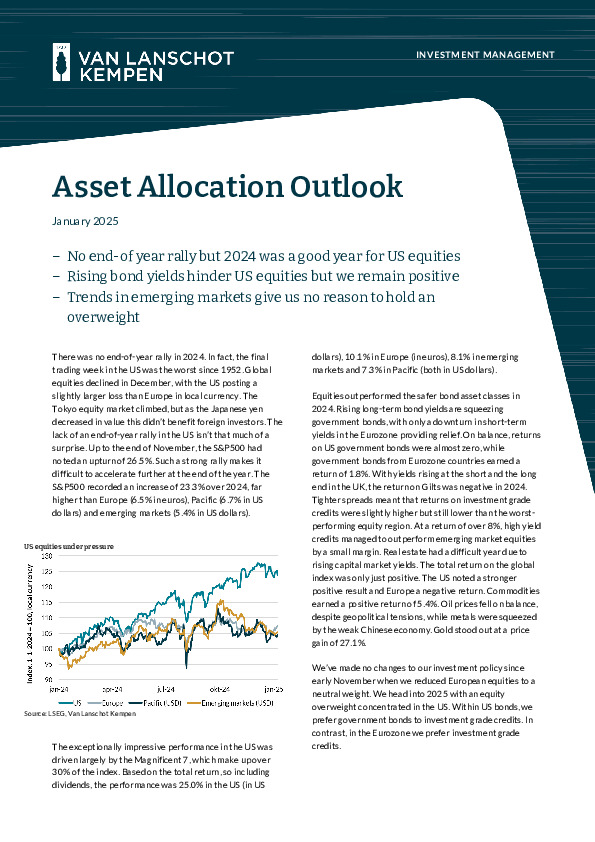

• Equities: Strong 2024 U.S. gains (+23.3%) driven by tech stocks, though tempered by rising bond yields and inflation risks. U.S. equities remain overweight due to strong economic growth.

• Fixed Income: Neutral stance on bonds; U.S. government bonds preferred over investment-grade credits due to tight spreads.

• Emerging Markets:*Underperformance attributed to weak economic growth and policy concerns in China.

• Commodities & Real Estate: Neutral, with real estate affected by rising yields and commodities limited by weak demand.

Access the full report for deeper insights into 2025 strategies.