This report by Robert M. Almeida Jr., part of the Strategist’s Corner series, analyzes the implications of reduced government intervention under a second Trump administration.

• Market Sentiment: The S&P 500 rallied post-election, with investor optimism fueled by expectations of deregulation and a smaller government role in markets.

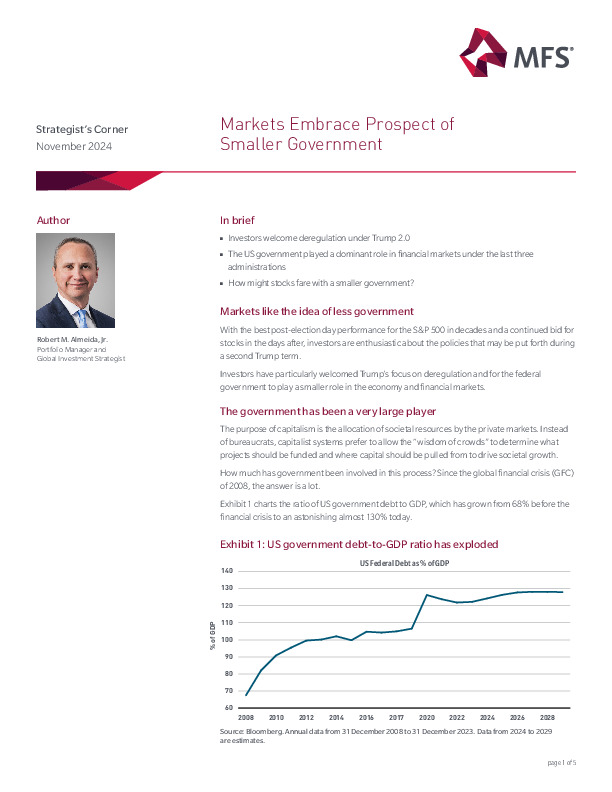

• Economic Landscape: U.S. government debt-to-GDP surged to 130%, and Federal Reserve interventions significantly expanded monetary supply, influencing asset prices.

• Valuation Concerns: Elevated Shiller CAPE ratios highlight risks, particularly if tariffs and rising input costs pressure corporate margins.

For deeper insights into strategic positioning amid these dynamics, access the full report.

To read this article, you need a subscription to Investment Officer. If you don't have a subscription yet, click on 'Subscribe' to see the various subscription options.