This asset allocation outlook from Van Lanschot Kempen, led by Joost van Leenders, provides insights into current market dynamics and tactical adjustments for portfolio strategy.

• Equity Positioning: Overweight in U.S. equities is maintained due to robust earnings growth, while European exposure is reduced to neutral amid weaker growth and earnings dynamics.

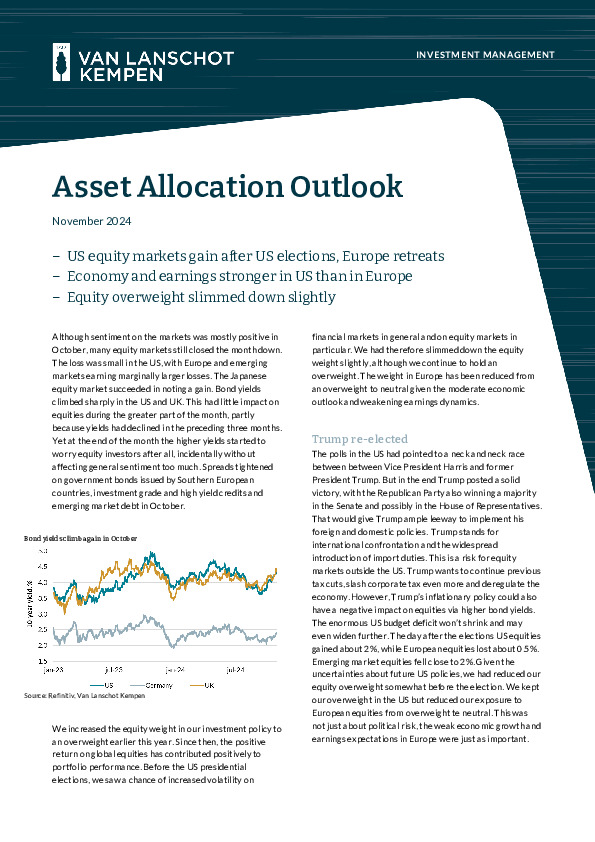

• Fixed Income: Cautious on high-yield and investment-grade credits as spreads remain tight; U.S. government bonds are preferred.

• Commodities and Real Estate: Neutral stance, with limited upside due to weak global industrial demand and high refinancing costs for real estate.

For a detailed breakdown of asset class performance and strategic recommendations, access the full report.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.