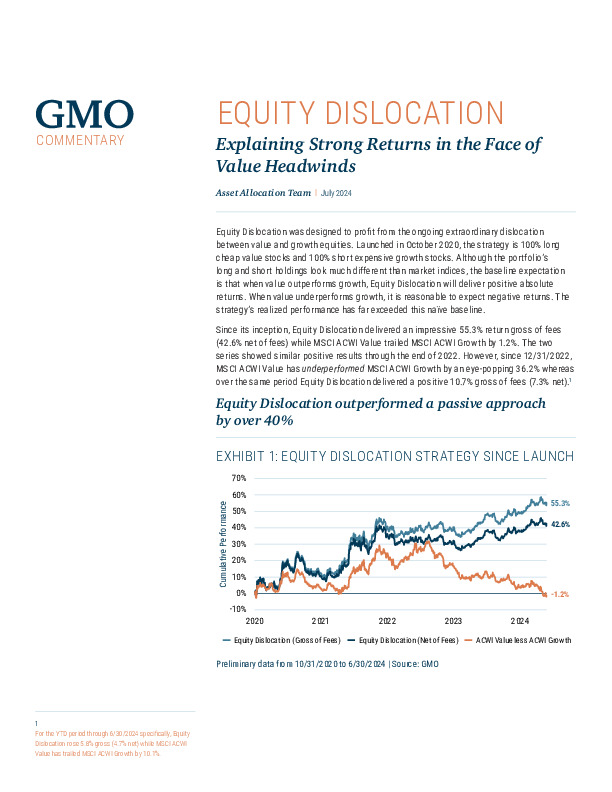

Equity Dislocation was designed to profit from the ongoing extraordinary dislocation

between value and growth equities. Launched in October 2020, the strategy is 100% long cheap value stocks and 100% short expensive growth stocks. Although the portfolio’s long and short holdings look much different than market indices, the baseline expectation is that when value outperforms growth, Equity Dislocation will deliver positive absolute returns. When value underperforms growth, it is reasonable to expect negative returns. The strategy’s realized performance has far exceeded this naïve baseline.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.